In today’s dynamic economic landscape, achieving financial freedom has become a paramount goal for many individuals. The concept of passive income offers a pathway to escape the traditional 9-to-5 grind and build a sustainable source of wealth. In this guide, we delve into 15 Passive Income Ideas for Financial Freedom that can revolutionize your financial journey.

Table of Contents

Embracing the Power of Passive Income with Financial Freedom

Generating passive income entails earning money with minimal effort or direct involvement. Unlike active income, where you exchange time for money, passive income allows you to build wealth through smart investments, creative ventures, and strategic planning. Let’s explore various avenues to unlock the potential of passive income.

Leveraging Real Estate Investments

Investing in real estate remains one of the most reliable ways to generate passive income. Whether through rental properties, real estate investment trusts (REITs), or property crowdfunding platforms, the real estate market offers lucrative opportunities for long-term wealth accumulation.

Harnessing the Potential of Dividend Stocks

Dividend stocks provide a steady stream of passive income through regular dividend payments. By investing in reputable companies with a history of consistent dividends, investors can enjoy both capital appreciation and ongoing income without actively managing their portfolios.

Exploring High-Yield Savings Accounts

High-yield savings accounts offer a safe and low-risk option for generating passive income. With competitive interest rates and minimal maintenance requirements, these accounts provide a reliable avenue for growing your savings over time.

Building a Robust Portfolio of Index Funds with Financial Freedom

Index funds offer a diversified approach to passive investing, allowing investors to gain exposure to a broad range of assets with minimal fees. By tracking market indexes such as the S&P 500, index funds provide consistent returns over the long term, making them an ideal choice for passive investors.

Creating and Monetizing Digital Products

In the digital age, creating and selling digital products has emerged as a lucrative source of passive income. Whether it’s e-books, online courses, or software applications, digital products allow creators to earn passive income by leveraging their expertise and reaching a global audience.

Exploring Affiliate Marketing Opportunities Financial Freedom

Affiliate marketing involves promoting third-party products or services and earning a commission for each sale or referral. By leveraging affiliate networks and strategic marketing tactics, individuals can generate passive income through affiliate partnerships without the need to create their own products.

Monetizing Your Passion through YouTube

YouTube offers a platform for content creators to share their passions and expertise with a global audience while earning passive income through advertising revenue, sponsored content, and affiliate marketing partnerships. With engaging content and strategic monetization strategies, YouTube channels can become lucrative sources of passive income.

Investing in Peer-to-Peer Lending Platforms

Peer-to-peer lending platforms connect borrowers with investors, offering an alternative investment avenue for generating passive income. By diversifying across multiple loans and assessing credit risk, investors can earn attractive returns while helping individuals access financing outside traditional banking channels.

Building a Profitable Blogging Business

Blogging remains a popular choice for aspiring entrepreneurs looking to earn passive income online. By creating valuable content, driving traffic through SEO and social media, and monetizing through display advertising, sponsored content, and affiliate marketing, bloggers can build profitable online businesses.

Also Read : 5 Legitimate Ways to Make Money Online in 2024

Renting Out Unused Assets

Renting out unused assets, such as a spare room on Airbnb, a parking space, or even your car, can provide a steady stream of passive income with minimal effort. By leveraging sharing economy platforms, individuals can monetize their assets and maximize their earning potential.

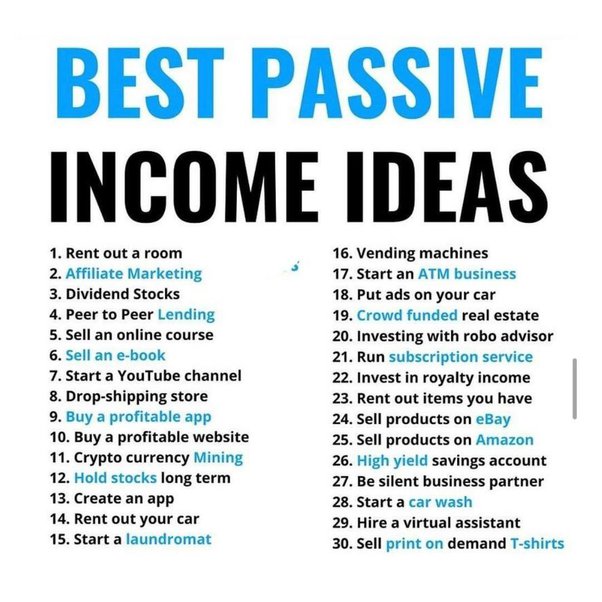

15 Passive Income Ideas for Financial Freedom

In this section, we dive deeper into 15 Passive Income Ideas for Financial Freedom, exploring diverse strategies to build wealth and achieve financial independence.

- Real Estate Crowdfunding: Invest in high-quality real estate projects through crowdfunding platforms, earning passive income through rental yields and property appreciation.

- Peer-to-Peer Lending: Diversify your investment portfolio by lending money to individuals or businesses through peer-to-peer lending platforms, earning interest on your loans.

- Dividend Reinvestment Plans (DRIPs): Automatically reinvest dividends from stocks or mutual funds to purchase additional shares, accelerating wealth accumulation over time.

- Rental Properties: Generate passive income by renting out residential or commercial properties, leveraging rental income to cover mortgage payments and expenses.

- High-Yield Bond Funds: Invest in bond funds that offer attractive yields, providing a steady stream of passive income while preserving capital.

- Create an Online Course: Share your expertise and knowledge by creating and selling online courses on platforms like Udemy or Teachable, earning passive income from course sales.

- Royalties from Intellectual Property: Earn passive income by licensing or selling intellectual property such as patents, trademarks, or royalties from books, music, or artwork.

- Create a Mobile App: Develop a mobile app that solves a specific problem or fulfills a need in the market, monetizing through in-app purchases, subscriptions, or advertising revenue.

- High-Dividend ETFs: Invest in exchange-traded funds (ETFs) that focus on high-dividend stocks, providing a diversified portfolio of income-generating assets.

- Create a Membership Site: Build a membership site that offers exclusive content, resources, or community access, monetizing through subscription fees or premium memberships.

- Sell Stock Photos or Videos: Monetize your photography or videography skills by selling stock photos or videos on platforms like Shutterstock or Adobe Stock, earning royalties with each download.

- Create a Podcast: Launch a podcast on a niche topic, attracting listeners and monetizing through sponsorships, advertising, or listener support through platforms like Patreon.

- Automated Dropshipping Business: Set up an automated dropshipping business, selling products through an online store without the need to handle inventory or shipping logistics.

- Invest in Cryptocurrency: Diversify your investment portfolio by investing in cryptocurrencies like Bitcoin or Ethereum, leveraging the potential for capital appreciation and passive income through staking or lending.

- Create a YouTube Channel: Share engaging content on a YouTube channel focused on your passion or expertise, monetizing through advertising revenue, sponsored content, and affiliate marketing partnerships.

How much passive income can I expect to earn?

Passive income potential varies depending on factors such as investment size, strategy, and market conditions. With careful planning and diversification, individuals can generate significant passive income streams over time.

Are passive income strategies risk-free?

While passive income strategies offer potential rewards, they also come with inherent risks. It’s essential to conduct thorough research, assess risk tolerance, and diversify investments to mitigate potential losses.

Do I need a large initial investment to start earning passive income?

Not necessarily. Many passive income strategies can be initiated with minimal capital, such as affiliate marketing, creating digital products, or renting out unused assets.

FAQs

- How much passive income can I expect to earn? Passive income potential varies depending on factors such as investment size, strategy, and market conditions. With careful planning and diversification, individuals can generate significant passive income streams over time.

- Are passive income strategies risk-free? While passive income strategies offer potential rewards, they also come with inherent risks. It’s essential to conduct thorough research, assess risk tolerance, and diversify investments to mitigate potential losses.

- Do I need a large initial investment to start earning passive income? Not necessarily. Many passive income strategies can be initiated with minimal capital, such as affiliate marketing, creating digital products, or renting out unused assets.

- How can I accelerate wealth accumulation through passive income? Consistent reinvestment of earnings, strategic portfolio management, and continuous learning are key to accelerating wealth accumulation through passive income.

- Can passive income replace my active income entirely? While achieving full replacement of active income with passive income is possible, it typically requires significant time, effort, and strategic planning. Start by setting realistic goals and gradually scaling passive income streams over time.

- What are the tax implications of passive income? Taxation on passive income varies depending on the source and jurisdiction. Consult with a tax professional to understand applicable tax laws and optimize your passive income strategy for tax efficiency.

Conclusion

Unlocking financial freedom through passive income is not only achievable but also transformative. By implementing the strategies outlined in this guide and staying committed to your financial goals, you can build sustainable wealth, enjoy financial independence, and live life on your own terms.