India’s startup ecosystem has witnessed exponential growth in recent years, emerging as one of the most vibrant and dynamic hubs for innovation globally. With a conducive environment for entrepreneurship, supported by government initiatives, technological advancements, and a burgeoning pool of talent, India has become a hotbed for startups across various sectors.

Table of Contents

The Rise of Seed Funding

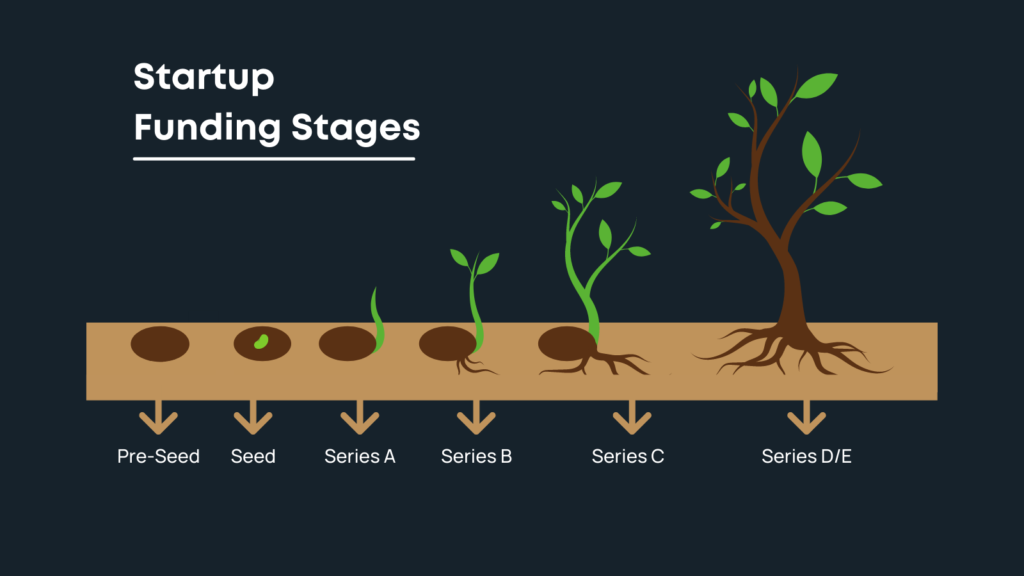

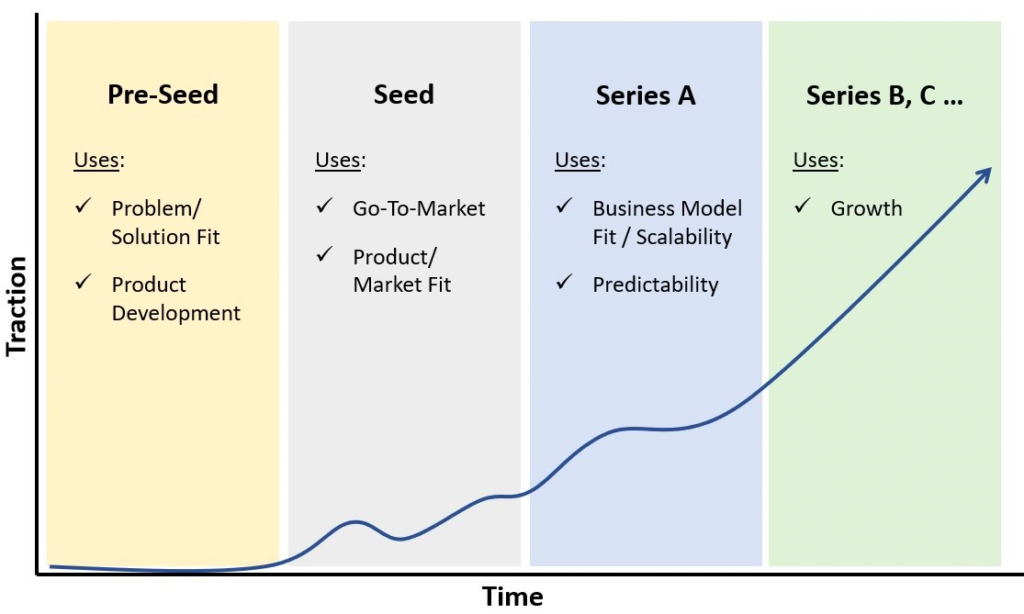

Seed funding serves as the lifeblood for early-stage startups, providing crucial capital infusion to transform innovative ideas into viable businesses. In India, the rise of seed funding can be attributed to the increasing investor interest, the proliferation of incubators and accelerators, and the growing acceptance of risk capital.

Key Players in Seed Funding

Understanding the key players in the seed funding landscape is essential for startups navigating their fundraising journey. From angel investors and venture capitalists to crowdfunding platforms and government schemes, various avenues exist for startups to secure seed funding and propel their growth trajectory.

Impact of Seed Funding on Startup Growth

The infusion of seed funding not only provides startups with the financial resources to fuel their growth but also opens doors to mentorship, networking opportunities, and strategic guidance. This holistic support ecosystem enables startups to iterate, pivot, and scale their operations effectively, laying the foundation for long-term success.

Challenges and Opportunities

While seed funding presents immense opportunities for startups, it also comes with its fair share of challenges and uncertainties. From intense competition and market volatility to regulatory hurdles and investor expectations, startups must navigate a myriad of obstacles on their journey to success.

Navigating Regulatory Landscape

The regulatory landscape in India can be complex and ever-evolving, posing challenges for startups seeking seed funding. Understanding compliance requirements, tax implications, and regulatory frameworks is crucial for startups to ensure legal and financial stability.

Harnessing Technological Innovations

Technological innovations such as blockchain, artificial intelligence, and the Internet of Things (IoT) are reshaping the startup landscape in India. Startups leveraging these cutting-edge technologies have the potential to disrupt traditional industries and carve out a niche for themselves in the market.

Tapping into Global Markets

In an increasingly interconnected world, startups have unprecedented opportunities to tap into global markets and cater to diverse customer segments. Expanding beyond domestic boundaries not only accelerates growth but also exposes startups to international best practices, talent pools, and investment avenues.

Also Read: Unlock Lucrative Careers in AI 2024: Opportunities and Paths

Case Studies and Success Stories

Examining real-world case studies and success stories provides valuable insights into the efficacy of seed funding in driving startup growth and innovation. From bootstrapped ventures to unicorn startups, each success story offers unique lessons and actionable takeaways for aspiring entrepreneurs.

Case Study: Flipkart

Flipkart, India’s leading e-commerce platform, started as a humble online bookstore with seed funding from angel investors. Through strategic partnerships, innovative marketing, and relentless focus on customer experience, Flipkart grew into a multi-billion-dollar unicorn, setting benchmarks for the Indian startup ecosystem.

Case Study: Ola Cabs

Ola Cabs revolutionized the transportation sector in India with its on-demand ride-hailing platform, backed by seed funding from prominent investors. By leveraging technology to optimize operations, expand its service offerings, and enter new markets, Ola emerged as a market leader, disrupting traditional taxi services.

FAQs (Frequently Asked Questions)

What is seed funding, and how does it work?

Seed funding refers to the initial capital infusion provided to startups in exchange for equity ownership. It typically occurs in the early stages of a startup’s journey and is used to validate product-market fit, develop prototypes, and hire key talent.

How can startups attract seed funding?

Startups can attract seed funding by articulating a compelling business idea, demonstrating market potential, building a strong team, and showcasing traction or early customer validation. Networking with investors, participating in pitch events, and leveraging online platforms are also effective strategies.

What are the common challenges faced by startups in securing seed funding?

Common challenges faced by startups in securing seed funding include market competition, lack of investor confidence, insufficient traction, valuation concerns, and regulatory hurdles. Overcoming these challenges requires perseverance, strategic planning, and effective communication.

What role do angel investors play in seed funding?

Angel investors play a crucial role in seed funding by providing capital, mentorship, and strategic guidance to early-stage startups. Their experience, networks, and domain expertise can significantly enhance the growth prospects of startups, paving the way for future fundraising rounds.

Are there any government schemes or initiatives to support startups in India?

Yes, the Government of India has launched several schemes and initiatives to support startups, including the Startup India program, Atal Innovation Mission, and various state-specific startup policies. These initiatives aim to foster entrepreneurship, promote innovation, and provide financial incentives to startups.

How does seed funding contribute to job creation and economic growth?

Seed funding fuels job creation and economic growth by empowering startups to hire talent, invest in research and development, and expand their operations. As startups scale and succeed, they contribute to job creation across various sectors, drive innovation, and stimulate economic activity.

Conclusion

Seeding Growth: Understanding Seed Funding in India’s Startup Ecosystem is paramount for entrepreneurs, investors, and ecosystem stakeholders alike. By unraveling the intricacies of seed funding, exploring success stories, and addressing common challenges, this article aims to equip readers with the knowledge and insights needed to thrive in India’s dynamic startup landscape.