Investors are always on the lookout for lucrative opportunities, especially in the ever-evolving landscape of the stock market. One such opportunity that has been gaining attention recently is the initial public offering (IPO) of Bharat Highways Infrastructure Investment Trust (INVIT). In this article, we will delve into the details of Bharat Highways INVIT IPO, exploring what it entails and the potential it holds for investors.

Table of Contents

Understanding Bharat Highways INVIT

What is an INVIT?

Before delving into the specifics of Bharat Highways INVIT IPO, it’s essential to understand what an INVIT is. INVIT stands for Infrastructure Investment Trust, which is a type of investment vehicle that enables developers to monetize completed infrastructure projects. These trusts are designed to attract long-term institutional investors by offering stable returns backed by revenue-generating infrastructure assets.

Background of Bharat Highways INVIT

Bharat Highways Infrastructure Investment Trust, commonly referred to as Bharat Highways INVIT, is a trust established to own, operate, and maintain national and state highways in India. It is sponsored by a reputable infrastructure company and holds a diverse portfolio of highway projects across the country.

Reasons behind the IPO

Several factors have contributed to the decision to launch the Bharat Highways INVIT IPO.

Growth prospects

The infrastructure sector in India is witnessing rapid growth, driven by government initiatives and increasing private sector participation. By going public, Bharat Highways INVIT aims to capitalize on this growth trajectory and raise capital for expanding its portfolio of highway projects.

Funding infrastructure projects

Proceeds from the IPO will be used to fund new infrastructure projects and repay existing debts, thereby strengthening the trust’s financial position and enhancing investor confidence.

Potential benefits for investors

Investing in Bharat Highways INVIT IPO offers several potential benefits for investors.

Stable returns

INVITs are known for offering stable and predictable returns, thanks to their revenue-generating infrastructure assets. Investors can benefit from steady cash flows generated by toll collection and other revenue streams associated with highway projects.

Diversification opportunity

Bharat Highways INVIT provides investors with an opportunity to diversify their portfolio by gaining exposure to the infrastructure sector, which tends to have low correlation with traditional asset classes such as equities and bonds.

Tax benefits

Investors may also enjoy tax benefits by investing in Bharat Highways INVIT, as dividends distributed by INVITs are typically exempt from tax at the trust level.

Risks associated with investing in INVIT IPO

While Bharat Highways INVIT IPO presents attractive opportunities, it is essential for investors to be aware of the risks involved.

Also Read : How to Trade in Stock Market: A Beginner’s Guide

Market volatility

Like any other investment, INVITs are subject to market volatility, which can impact their unit prices. Fluctuations in interest rates, economic conditions, and investor sentiment can affect the performance of Bharat Highways INVIT.

Regulatory changes

Changes in regulations governing the infrastructure sector or taxation policies can have a significant impact on INVITs and their investors. It’s crucial for investors to stay updated on regulatory developments and assess their potential implications.

Infrastructure project risks

Investing in infrastructure projects carries inherent risks, such as construction delays, cost overruns, and operational challenges. While Bharat Highways INVIT aims to mitigate these risks through prudent project management, investors should be prepared for unforeseen challenges.

How to participate in Bharat Highways INVIT IPO

Investors interested in participating in Bharat Highways INVIT IPO can follow these steps.

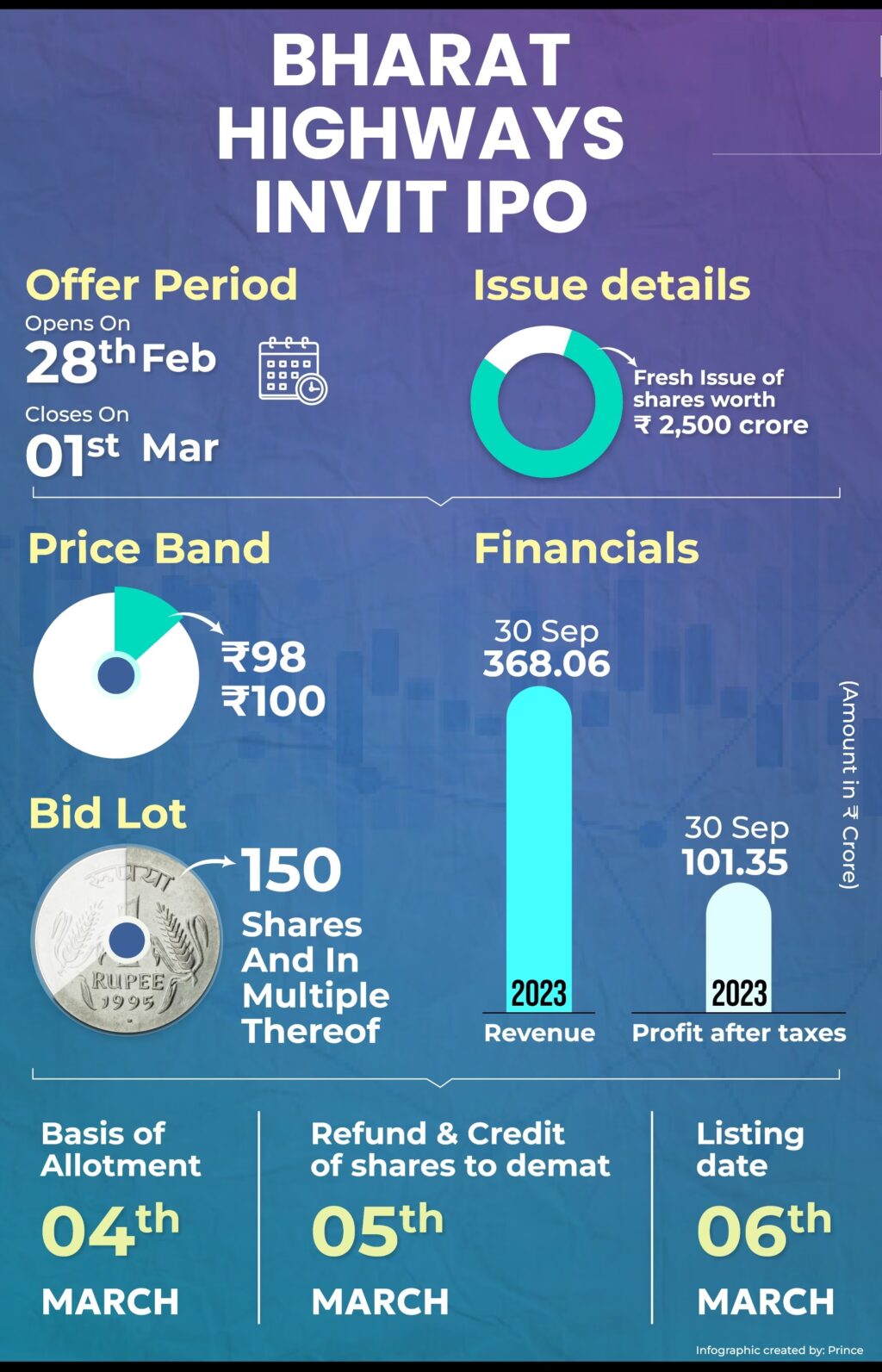

IPO process

The IPO process typically involves filing a draft offer document with the regulatory authorities, followed by a roadshow to generate investor interest. Once the offer document is approved, the IPO is launched, allowing investors to subscribe to the units of the trust.

Eligibility criteria

To participate in Bharat Highways INVIT IPO, investors must meet certain eligibility criteria, such as being a registered investor with a recognized stockbroker or depository participant.

Steps to apply

Investors can apply for Bharat Highways INVIT IPO through their stockbroker or by using the online platform provided by the issuing company. They need to submit the application form along with the requisite documents and payment for the subscribed units.

Analyzing the financial performance

Before investing in Bharat Highways INVIT IPO, it’s essential to analyze its financial performance.

Revenue streams

Bharat Highways INVIT generates revenue primarily through toll collection, annuity payments, and other contractual sources associated with its highway projects.

Profitability indicators

Investors should assess key profitability indicators such as net income, operating margins, and return on investment to gauge the trust’s financial health and performance.

Expert opinions and market outlook

Finally, investors may benefit from seeking expert opinions and market outlook regarding Bharat Highways INVIT IPO. Consulting financial advisors and industry experts can provide valuable insights and help investors make informed decisions.

Conclusion

In conclusion, Bharat Highways INVIT IPO presents an attractive opportunity for investors seeking exposure to the infrastructure sector. With its stable returns, diversification benefits, and potential tax advantages, it can be a valuable addition to investors’ portfolios. However, investors should carefully evaluate the risks and consider seeking professional advice before making investment decisions.

FAQs (Frequently Asked Questions)

- Is investing in INVITs suitable for all types of investors?

- While INVITs offer attractive benefits, they may not be suitable for all investors. It’s essential to assess your risk tolerance and investment objectives before investing.

- How are dividends distributed in Bharat Highways INVIT?

- Dividends in Bharat Highways INVIT are typically distributed to unit holders on a regular basis, subject to applicable regulations and the trust’s distribution policy.

- What factors should I consider when analyzing the financial performance of an INVIT?

- When analyzing the financial performance of an INVIT, investors should consider factors such as revenue streams, profitability indicators, debt levels, and cash flow generation.

- Are there any tax benefits associated with investing in Bharat Highways INVIT?

- Yes, investors may enjoy tax benefits from investing in Bharat Highways INVIT, as dividends distributed by INVITs are typically exempt from tax at the trust level.

- How can I stay updated on regulatory changes affecting INVITs?

- Investors can stay updated on regulatory changes affecting INVITs by following regulatory announcements, consulting financial advisors, and monitoring industry news and developments.